Mandatory Bonuses to Employees

1. Issue national corporate charters to the largest corporations with more than 5,000 employees.

2. Mandate annual bonuses to all employees earning less than $70,000/year.

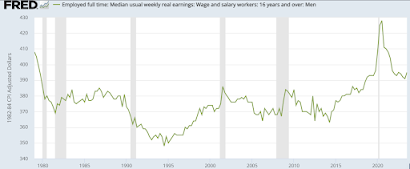

The largest U.S. corporations have allocated 96% of their profits to shareholders (owners) through stock buybacks and dividend outlays over the ten year period 2012 to 2021, and even since 2003 shows the research of William Lazonick. Wages for 80% of all workers have not grown since 1969. The Bureau of Labor Statistics shows wages for 80% of workers are no higher since 55 years ago, while the "Real" (inflation adjusted) per capita income has grown by 181%, nearly tripling. The result is stifling inequality, 41% of Americans are either poor or struggling with expenses. RealTime Inequality documents an income shift of 15.4% of total national income (from 37.7% to 53.1%) going in favor of the top-earning 10%. (See my previous posting.) Restoring the income distribution profile of 1976 would add between $27,000 to $30,000 to 90% of all households and families, all who earn less than $200,000 per year.

The big picture: income for all triples, but for 80% of workers income stays flat; 41% of Americans live in poverty or hardship. If we had the income distribution of 1976, then 90% of households (all with annual incomes below $200,000) would all have about $30,000 more income, and poverty would be eliminated. About $3.4 trillion of income would be shifted back to the lower 90% of households. Get the big picture.

Another proof of the egregious maldistribution is the case of wealth. RealTime Inequality (dot org) also shows the track of wealth growth from 1976 to the present. The top 14,300 tax-payers (0.01%) in 2023 own an average of $578 million; the lower-saving half, 108,000,000 tax-payers, own an average of $9,000. Over 47 years, from 1976 to 2023, the top group saw their total savings grow from $30 million to $578 million (average), by a multiple of 19 times. The lower earning half, 50%, grew their savings by 3 times, and the group between 50% and 90% also grew their savings by 3 times. The lower 50% gained $6,500 more wealth, the top 0.01% group gained $548,000,000. I say the economy is broken. The total national income, $22.713 trillion (see here page 10) divided evenly among 133 million U.S. households comes to an average household income of $170,000 -- yet half have incomes below $80,000; the lower half average is below $40,000. This badly performing system causes a lot of pain that could be fixed with radical reform that is very possible.

The economy has egregious maldistribution. In the face of this, what can we do? Labor union power is one solution; I look for the PRO Act, the Reward Work Act, Sectoral Bargaining, and Full Employment to restore widespread prosperity to American society that has been lost since the 1970s. I have to remind myself of other methods: the creation of cooperative enterprises, the advancement of profit sharing in large corporations, and increasing the Earned Income Tax Credit and the national minimum wage (see below). I have The New Systems Reader on the shelf for tomorrow's reading list. Maybe that covers all the bases. But the mandatory yearly bonus at large corporations is also a viable instrument for raising family incomes.The economy belongs to the people, to us, the community, to all workers and families, if we will demand our ownership.

The largest corporations would be required to pay a yearly bonus out of total pre-tax profits. There are more than 2,000 giant corporations in the U.S. who employ more than 5,000 workers; their average number of employees is over 20,000. More than 40 million workers comprise this group, over a quarter of all workers in the U.S. (see Lazonick, p. 6). To cite another essay, Lazonick states that over 10 years, 2012 - 2021, the largest 474 corporations "funneled $5.7 trillion into the stock market as buybacks, equal to 55% of their combined net income, and paid $4.2 trillion to shareholders as dividends, another 41% of net income." Simplified, 96% of their net income was dispersed, about $9.9 trillion over ten years. Pre-tax profits for all "nonfinancial corporations" in Q4 2021 amounted to $1.981 trillion. Roughly half of those profits went to the largest 500 corporations. (See Fed's Flow of Funds, page 10) Christian Weller supplies this graph for a clear understanding:

If half that $9.9 trillion went to around 40 million workers, about 40% of full-time employees, each would receive approximately $12,000 more income each year. These firms would be required to register with a national corporate registry and pay a portion of profits, up to 50%, to workers earning below 150% of the median annual worker income. As the median annual worker's income in 2022 was $40,847, 150% is $61,270. In 2022 around two thirds of workers (108 million) earned less than $60,000. Why isn't the median household income (around $80,000) closer or even equal to the average ($170,000)? Our condition is the reverse of democracy. We could also mandate a minimum wage for workers at these giant companies at about $22 per hour, indexed to inflation. Such a wage hike has been proposed in New York state. The hike would raise incomes by $3,307 for 32% of New York workers. This plan I present is called a prototype, not a finished plan, but the reader gets the general idea. As I show below, these "domestic nonfinacial corporations" have doubled their pre-tax profits in the last four years.

The chart above comes from BEA.gov, Table 6.16.D, nonfinancial corporation pre-tax profits rising from $1,332 billion in Q4 2019 to $2,694 billion in Q4 2023, 4 years, a gain of 102.2%. Adjusting for inflation it's a gain of 69.4%. Inflation increased by 19.4%. Profits increased 3 times faster than inflation. "Profit Inflation Is Real" is the title of Servaas Storm's essay. There are many others in agreement.(here and here)

Mandatory employee bonuses is my quick solution to the gross malfunction and inequality plaguing the U.S. economy. What follows is a lengthened comment I left at an article by William Lazonick, "The Scourge of Corporate Financialization". The target is to raise the incomes of lowest paid workers. I suggest the reader go to RealTime Inequality, adjust the graphs for "factor income" and "working age adults". There you'll see the average annual income for the lower 50% is $25,200. The average for the top 10% is 18 times higher, $448K. This is harmful for the economy and society. This low-earning half desperately needs a raise, and the nation can easily afford to make it happen. The minimum wage hike to $22 an hour would be major, and the bonus would bring their incomes more in line with their contribution. The magazine In These Times has an article on this topic, several by Colleen Boyle. Walmart also has received critical reporting on its emphasis on low-pay but very high profits going to shareholders. I estimate that each Walmart employee in the U.S. generates over $62,000 in profits, but the half of all Walmart workers received annually less than $27,136 states this report, page 13.

For fuller details see the paragraph almost at the bottom of this essay with this heading:

William Lazonick's Research on Corporate Profits and Greed

Walmart had a CEO to worker pay ratio of 931 to 1, and each of their workers could have had a $6,600 pay increase if the retailer, instead of buying back stock, had delivered a raise to each worker, who earned at the median $27,136 per year, or $15.96 per hour. A worker in Louisville, Kentucky, with a wife and 2 children pays $1,052 per month rent. If he is the median paid Walmart worker, his income is $2,261/month. After paying rent, he or she might have $1,200 for all other expenses. The Economic Policy Institute estimates this 4 person family in Louisville needs $7,756/month ($93,072/year) to afford a moderate life style, not $2,260/month. This four person family needs $93,072/year. (The average household income in the U.S. is $170,000/year.) Two workers at a lousy paying corporation would still find themselves about $3,000 per month short (or about $36,000/year more, which is about $17.00 more per hour) "in order to attain a modest yet adequate standard of living." Or, to make it clearer, 2 workers earning $27,136/year, with a combined income of $54,272, still need about $40,000 more per year. And still their income would be $77,000 less than the average household income for all, $170,000. It's rather bleak, isn't it? -- See the Economic Policy Institute's Family Budget Calculator.

Lousy Pay Is Endemic in Large Corporations

The study Executive Excess shows the lousy pay from the 100 most-lousy paying large corporations in the S&P 500. Its #1 finding:

1. The CEO-worker pay gap at the Low-Wage 100 averaged 603 to 1 in 2022The lousiest paying large corporations pay workers as little as they can. Their executives make 603 times their middle paid workers, states the reporting from Executive Excess. From page 5: "Last year, median worker pay at these Low-Wage 100 companies averaged $31,672, and the gap between CEO and median worker pay at these enterprises averaged 603 to 1." That would equal $15.22 per hour for a full-time worker. At Lowe's hardware, the giant mega-hardware, it's median worker earns $29,384, which is $14.12 per hour for a full-time worker. Of course, the median earning Lowe worker is not full-time. The "average" household income in the U.S. is $170,000 per year. I show more about this later. "Can we afford higher wages?" strikes me as an ignorant question.

Another example, The Dollar Tree:

"Dollar Tree: CEO Michael Witynski reaped the biggest stock gain in the Low-Wage 100. During his three year stint before resigning in early 2023, his personal stock holdings ballooned 2,393 percent to $30.5 million. Dollar Tree’s median pay fell 4.4 percent to just $14,702 in the same time period, while the retailers’ customers saw an increase in most products from $1 to $1.25. The retailer has spent over $2 billion on buybacks since 2020."

The Average Household Income in 2024 --- $170,000 per year

I walked today around the little neighborhood where I live in Mariposa, California. My friend and neighbor with two chihuahua dogs walked with me and got me talking about the economy. I mentioned that the average household income in the U.S. is $170,000. She didn't believe me, so I explained, and she still had a hard time believing. This paragraph is an aside -- I'm adding it much after the other parts. The theme is "What is the average household income in 2024?" The answer: $170,000. Let me explain: four sources confirm this number. How many households in the U.S. is answered by the U.S. Census: 131,434,000 in 2023. What's the total income? The Congressional Joint Committee on Taxation, Overview, states it's $19.926 trillion (see page 39). The Federal Reserve's report Flow of Funds says it's $22.5121 trillion (see page 10). The Bureau of Economic Analysis says $23.289 trillion (see bea.gov, Interactive Table 2.1). The "average household income" answer is either $151,604, or $171,280, or $177,191, respectively. Let's try RealTime Inequality; their answer is $22.2 trillion total, yielding an average of $168,906. The average for the lower-earning 50% of households is $36,546 (says dqydj.com, household income by percentile calculator). The average for all households, $170K, is about five times the average of the lower half's average, $36K. This paragraph may read like over-kill, but I have a hunch my neighbor is like most people -- totally ignorant and unbelieving, but willing to listen and learn. Her two dogs enjoyed the other dogs along the way, and returned home very happy. Change happens gradually, but it needs conversation and actual facts. I hope everyone will have this conversation, and act on it.

But first -- My May, 2023, essay says that 90% of U.S. household earn less than $200,000 per year (117 million out of 130 million), and all 90% could/would have $29,000 more income each year if we had the income distribution ratios of 1976, according to data from RealTime Inequality. This is an important claim; in the near past we had a much more equitable economy; it is possible to enrich everyone; we did it before. I load so much data and information into these essays, I hope readers take away at least one thought. Take your choice. You don't have to understand everything, just understand we have fixable inequality. It depends on a mass public understanding, and then voting for common sense equality of income and wealth. ------- Read on -----

*** *** *** *** *** *** ****

We might require the largest corporations to share 50% of profits in bonuses to employees. This sharing of profits would raise incomes considerably. This would be a statutory requirement for corporate licenses, only applied to companies with more than 2,000 workers. Something like that. Nonfinancial domestic corporations have increased their profits by 95% since October of 2019 (from $1302 billion to $2551 billion), shows the Table 6.16D at BEA.gov, Interactive Tables. Here's the graph showing profits from 2011 to 2023 Q3:

A second, confirming report comes from the Flow of Funds report, a Federal Reserve quarterly report. It reports an increase of 91% (adjusting for inflation), (See December reports for 2019 and 2023, Table F.3, line 9). In Q3 2019 "domestic nonfinancial corporations" earned 6.0% of all income, and in Q3 2023 they earned 11.2% of all income. Adjusting for inflation the pre-tax profits of 2019 reveals the same 91% increase. (I did the inflation adjustment here.)

Inflation has gone up 19.7% over the same four year period shows the data at BLS.gov, see CPI data. The public should be asking very hard questions about corporate price hikes. The supply chain bottleneck problems are over, we have greed in operation. It seems to me absolutely impossible to generate such huge profits during a period of very high inflation. Corporations are making a killing at the expense of all consumers. Shareholders are the wealthy minority, and they are literally killing our economy. My January, 2023, essay is all about inflation and its causes.

By my calculations the share of national income going to nonfinancial corporations pre-tax profits increased from 6.0% in 2019 to 11.2% in 2023, Q3 for both years. I calculated the figures from the Fed's Flow of Funds report, Table F.3, Lines 1 and 10, from the Dec. 2019 report and Dec. 2023 report.. The increase of $1.202 trillion in profits means every household paid an additional $9,037 to corporations for the same amount of goods.

The Pulse Survey from the U.S. Census

Naturally not every household could afford such a huge increase. Hardship is the result; families experience added anxiety, worry, grief and ill-at-ease. The U.S. Census conducts a Pulse Survey almost every month, the last issue was November 2023, and they asked questions about many topics including "Spending" and "Health". When asked to rate "Difficulty paying usual household expenses over the last seven days" only 30% report no difficulty, another 30% state "a little difficult", and the last 41% report "somewhat" and "very difficult" about evenly divided. True to the United Way report, the ALICE report, 41% of U.S. households experience hardship. And the Census's Supplemental Poverty Report also reports 41% of households living with incomes less than 200 percent of the very low Official Poverty Line.

The Poverty threshold for a family of 4 is $29,950, that doubled is $59,900, but the United Way ALICE basic survival budget requires $73,464, the M.I.T. Living Wage Calculator requires $76,814, and the EPI.org Household Budget Calculator requires $72,640 in the median cost county of Des Moines, Iowa. But in late January, 2024, the EPI re-adjusted its calculator. Now EPI reports $90,260, which is 3 times the Official Poverty Line (OPL). And the M.I.T. Living Wage Calculator shows the living wage income needed is $95,763 if both parents are working. The M.I.T. report is dated February, 2023. The Census report HINC 01 shows the median household income for a 4 person household is $117,900 in 2022. The median is nearly 4 times the Official Poverty Level of $29,900 (4 times $29,900 is $119,600). So, 52% of 4 person households live with incomes below $119,600.

The Consumer Financial Protection Bureau report "Making Ends Meet"

A short quote from the 2023 document:

"More families had difficulty paying their bills, but average financial well-being was unchanged. The share of families with difficulties paying bills or expenses increased from 35.7 percent in 2022 to 37.8 percent in 2023 but is still below its 40.4 percent level in 2019."

"Looking to the future, many consumers are unprepared for an economic downturn, should one occur. If they lost their main source of income, 37 percent of households could not cover their expenses for more than a month. Half of Black and Hispanic households could not cover their expenses for more than a month."

The Supplemental Poverty Measure and the ALICE report

The U.S. Census' Supplemental Poverty Measure for 2022 (page 13) shows that just 22% of U.S. households have incomes 4 times above the OPL using the SPM (bluish-grey strip in the chart below); 78% have incomes below 4 times OPL. So, the total living with income above 4 times is 22%, but for 4 person households it is about 50%. The four-person houehold must be doing better than the other 1 and 2 and 3 person households who have at least 78% living below the 4 times OPL level. Using the HINC-01 data, about 40% of 4 person households earn too little, not the amount the EPI or the M.I.T. studies indicate are basic floors to avoid hardship. A basic survival income of $90,260 is 24% less than what half earn, the median, for a family of four ($117,900). This shows that about 39% of 4 person households live with incomes below the basic survival budget. Looks like the ALICE report is accurate. Hardship afflicts at least 40%, more or less, of Americans, the richest nation on earth. I should analyze the 1 and 2 and 3 person households, but I don't have the patience. If I did the conclusion would be worse, not better, is my guess. Excuse me. I'm not wasting your time, I hope.

This is page 13 or the 2022 year Supplemental Poverty Measure, U.S. Census

So, we might ask "What is the average household income in 2023?" The Flow of Funds tells us the national income in Q3 2023 was $22.512 trillion, and divided evenly among 133 million households, the average is $169,000. The median income for all 133 million was $74,580 in 2022. If the average were $1000, then 50% would be earning less than $450, and their average would be around $300. We have massive and harmful inequality.

A look at the U.S. Census Hinc 0-1 file shows the details of income distribution. But this site shows a total of $15.1 trillion as the national income, which is far short of the $22 trillion shown by the Flow of Funds or the Bureau of Economic Analysis. Furthermore, one should be sure to compare post-tax and post-transfers incomes with the same.

Corporations have subdued wage increases, and they have also had no restraint in raising prices.The "retail trade" corporations have seen their profits grow by 153% over the four year period, Oct. 2019 to Oct. 2023.

Retail trade profits since 2012 to Q3 2023.

In that 4 year period inflation rose by 19.6%. The net result is the impoverishment of workers, their families and communities. Does society benefit or only the profit driven corporations? Corporations should be forced to share their profits with workers. A national corporate licensing law would effect all large, multi-state corporations employing more than 5,000 workers. There should be a flexible rate of mandatory bonus dispersal, be it 50% or 10% or between both. Workers deserve raises.

The largest corporations are "looting" America claims professor William Lazonick. (See here and here) Between 2017 and 2019, 111.8% of their total profits were used for shareholder dividends or stock buybacks. In other words, they took all their market profits and also borrowed additional billions, going into debt, to buyback their own shares. His 2014 article in the Harvard Business Review claims that 91% of profits since 2003 have been dispersed through the combination of buybacks and dividends. The word 'eviscerating' captures the essence of this greed. That chart in Lazonick's recent essay, page 17, shows the growth of this process.

Wealth

Total national private wealth (household net worth) is almost $151 trillion (see here, page 1), which comes to $1.1 million per household as an average savings for all U.S. households. Yet the lower half own about 1% of all wealth (0.8% shows Realtime Inequality). Therefore, the average household net worth for the lower half of the U.S. is about $18,300. The Federal Reserve shows the lower half owning 2.6% of all wealth, about $59,500 per household. But the lower 40% own very little, just 0.7%, which equates to just less than $20,000 per household for the lower 40%. The average for all, again, is $1.1 million. (see the Credit Suisse Databook for 2022, page 144).

Here is the Fed's page on wealth, 1990 to 2023 Q3.:

Here is the RealTime Inequality page on wealth, 1976 to 2023, notice the growth of the yellow line, representing the top 1%, its share growing from 22.5% to 35.6%.

And also to bolster my case, a graph of the "median sales price of existing homes:

Requiring the largest employers to share their profits with workers is a natural response to this disaster. (Another chart can been seen here.)

The U.S. Census reports on business firm sizes; Wm. Lazonick (on page 6 and 7, here) reports that in "2017 some 2,156 firms with five thousand or more employees in the United States, with an average of 20,859 people on the payroll, accounted for 35.0 percent of all business-sector employees . . ." These 5,000-plus employee corporations are the ones I would target to disperse half their profits to workers. Let's say they create half of all nonfinancial corporate profits, about $1.132 trillion. Then each of the 64 million nonsupervisory workers, 40% of all workers, would receive around $9,000 in added pay each year. (I took the annualized pre-tax income for nonfinancial corporations, found on page 18, here, the Fed's Flow of Funds report.) But I think the details could be easily worked out. This policy would in turn add pressure for other employers to raise the wages of their employees. Therefore about 134 million workers would see the benefit.

The RealTime Inequality web page, created by economists at Univ. of California, Berkeley, shows that an income shift of 15.4% of total national income has happened between 1976 and 2023. That's $3.4 trillion that once went to the lower-earning 90% now goes to the top 10%. If that $3.4 tr. were restored to the 90%, then every household, 117 million, in the 90% would receive $29,000 more income. The lower 90% in 1976 received 62%, now it's 48%; the top 10% received 38%, now it's 53% (factor or market income, pre-tax). The average household income is $165,000 (Fed's Flow of Funds' report - page 10, line 1), but half of households earn less than half, half earn less than $74,580 in 2022. The average household income for the lower 50% is about $40,000 (see here). The average for the lower 50% is about 1 seventh the average for the higher 50%. That may seem incredible, but in my earlier essay I show that income distribution of 53% going to the top 10%, and 47% going to the lower 90%, the 1 to 7 ratio is accurate. The U.S. Gini for income inequality is above all OECD nations except Mexico and Turkey. And "Our World in Data" also shows income Gini higher than other developed countries. The median wage income in the U.S. was $37,587 for 2021, shows the Social Security report on wages. The average for the lower half is around $17,000, and 30% of all workers earn below $20,000/year. The total wage earnings for the lower half is less than 7% of the national income. Wages were higher for "nonsupervisory workers" in 1969 than in 2023. And as Lazonick cites, 69% of workers in Urban locations are living "paycheck to paycheck". --- A mandatory sharing of profits is needed to quickly change this crippling malfunction.

*** *** *** *** *** *** *** ***

Lazonick in his top paragraph links to six studies showing the fragility of working America. For instance, one shows that 61% of U.S. adults are living paycheck to paycheck, and 69% in urban areas. That paragraph is a good reference. A report he sources is from Oxfam America, The Crisis of Low Wages in the U.S.. If any reader gets this far in this essay, some other week or month later he or she may climb the mountain of the Oxfam report.

Writing for In These Times magazine, Colleen Boyle claims and proves that "In a Single year, $1.78 trillion Was Taken from the Working Class". Boyle claims, "In 2017 alone, then, the average worker lost $17,385 — because wages have not kept up with productivity."

In a two worker family that would mean an added $35,000 per year.

I am going to leave this as is, short, to the point. When I wrote "short", months ago, it was short. The posts that predate this long essay mostly repeat the details I've stuffed into this essay.

An excellent source of Facts on Inequality can be found here at Inequality.org. They offer an informative weekly newsletter also. Marjorie Kelly is featured in the newsletter of September 25, 2023. The Prosperity Now Scorecard also details state by state the disparities of income, wealth and home ownership.

I just discovered a few excellent articles at Common Dreams: Tim Koechlin has written about a dozen articles, the last echoes my own views. And I enjoyed this one by Bruce Boccardy; he also has published 12 articles, most recent was 10/29/23.

This blog entry has been much too long. I will quote Tim Koechlin, from his article linked to above; it's a fitting conclusion:

"The U.S. remains a very rich country. We have the capacity to do much better. We have the capacity to deliver equitable, sustainable prosperity—and we know how to do it. A detailed plan is beyond the scope of this short essay, but here’s a start: a tax on wealth; tax increases on corporations and the super-rich; a higher minimum wage; deliberate, active efforts to improve worker bargaining power; affordable health care for all; a well-funded effort to provide affordable housing for all; the promotion of renewable energy and sustainable production technologies, and affordable higher education—including the elimination of student debt. More generally, we need to reject the presumptions that (a) our well-being depends on growth and (b) prosperity requires that we pander to corporations."

No comments:

Post a Comment